Real estate investors are always on the lookout for opportunities to grow their portfolios and generate profitable returns. There are various strategies for wealth building and portfolio growth.

A strategy that has gained popularity among investors is the BRRRR method, which stands for Buy, Rehab, Rent, Refinance, and Repeat. It begins with purchasing a property below market value, renovating it strategically, generating rental income, refinancing to recoup capital, and then repeating the process. The method is designed to help real estate investors minimize irrelevant expenses and optimize their investments for long-term profitability.

By strategically following the approach, investors can build equity, generate rental income, and recycle capital, leading to a more efficient and successful real estate investment journey.

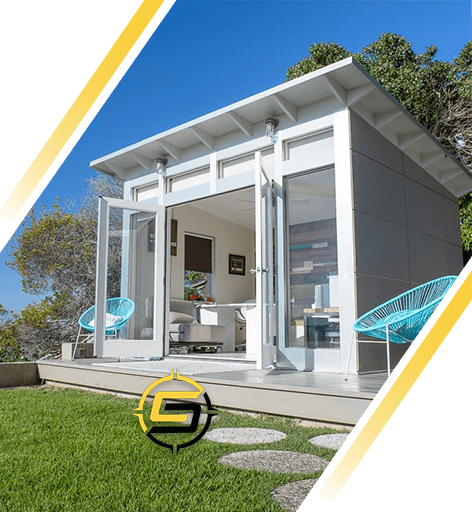

ADUs: Your Path to Profitable Returns with the BRRRR Strategy

The BRRRR method allows investors to maximize returns and recycle capital efficiently. A perfect way to make the most out of the strategy is to buy a property with the potential of having an Accessory Dwelling Units (ADU)..

Here is how the strategy can unlock potential profits for real estate investors.

Enhancing Equity Building

The first step in the BRRRR strategy is buying a property below market value to build equity. By incorporating an ADU into the equation, the real estate investors can amplify the potential for equity building. ADUs offer an opportunity to acquire properties at more attractive prices, especially those in need of rehabilitation or with the potential to build additional units.

Constructing ADU allows investors to add value and equity to the property from the outset, setting the stage for big returns down the road.

Boosting Rental Income and Cash Flow

A key objective of the BRRRR strategy is to generate rental income to support the investment and create positive cash flow. ADUs serve as an additional income stream, significantly increasing rental income potential and cash flow. Renting out both the primary dwelling and the ADU on the property can lead to higher monthly returns compared to traditional single-unit investments.

This enhanced cash flow not only provides financial stability to the real estate investors but also accelerates the payback period on the initial investment.

Leveraging Refinancing Opportunities

The “Refinance” step in the BRRRR strategy is where investors can recover a significant portion of their initial investment. By incorporating ADUs, you can access even more favorable refinancing opportunities. As the property’s overall value increases due to ADU rental income, the potential for refinancing at a higher appraisal value rises. Pulling out more capital through refinancing enables investors to recycle that money into new investments, fostering portfolio growth and scaling the BRRRR strategy.

Seizing on High Market Demand

ADUs are in high demand in Los Angeles due to shortage of affordable housing.

By providing a separate living space, ADUs offer privacy and independence for tenants, making them a lucrative option in the city’s high-demand rental market. Investing in ADUs allows investors to capitalize on this demand and secure a steady flow of rental income.

Diversifying Real Estate Portfolio

Incorporating ADUs into the BRRRR strategy adds diversification to the real estate portfolio of investors. With multiple rental units on a single property, investors can mitigate risk by spreading income streams across different units.

This diversification can offer stability and resilience to changing market conditions, making the investment more robust over the long term.

Final Words

The BRRRR strategy has long been hailed as a profitable real estate investment approach, allowing investors to build equity, generate rental income, and recycle capital. When paired with ADUs, it becomes even more potent, offering enhanced equity building, increased rental income, and greater refinancing potential.

Additionally, the high demand for ADUs in Los Angeles’ rental market further cements their position as a valuable addition to real estate investors’ portfolio. By leveraging the BRRRR method and building ADUs, investors can unlock a world of potential profits, and achieve financial goals at an accelerated pace.

Let Us Build Your Dream ADU

As with any investment strategy, building an ADU requires thorough research, due diligence, and a strong understanding of the local real estate market. Therefore, it is important to partner with an experienced contractor to make the process simple and straightforward for you.

For years, we have been helping homeowners and seasonal real estate investors bring their ADU vision to life.

From navigating you through the process to drawing the floorplans and securing the permits to building your ADU from the ground up, we can help you at every step of the way.

Reach out to us for a personalized consultation about your ADU endeavor.